Section 179 Bonus Depreciation 2024 Nj

Section 179 Bonus Depreciation 2024 Nj. The taxpayer may elect out of bonus depreciation, but can do so only for one or more full classes of property. Explain how strategies like section 179 expensing, bonus depreciation, the tangible property.

179 deduction for tax years beginning in 2024 is $1.22 million. Information is provided in the applicable tax return instructions regarding decoupling bonus depreciation and section 179 deductions from federal calculations.

Section 179 Bonus Depreciation 2024 Nj Images References :

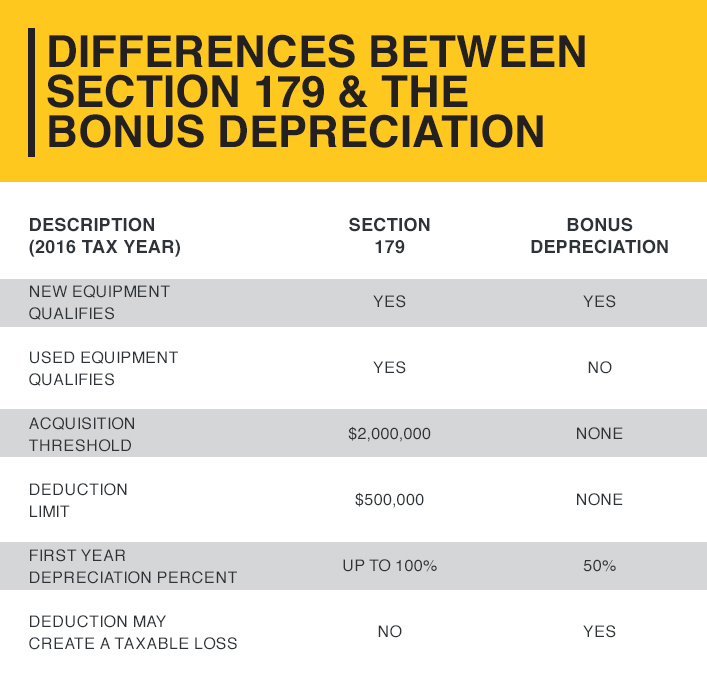

Source: www.clevelandbrothers.com

Source: www.clevelandbrothers.com

How to Writeoff Your Equipment Purchases Cleveland Brothers Cat, You can use this section 179 deduction calculator to estimate how much tax you could save under section 179.

Source: nevsaqkaylyn.pages.dev

Source: nevsaqkaylyn.pages.dev

Section 179 And Bonus Depreciation 2024 Lenka Imogene, 179 deduction for tax years beginning in 2024 is $1.22 million.

Source: www.netsapiens.com

Source: www.netsapiens.com

Section 179 IRS Tax Deduction Updated for 2024, Explain how strategies like section 179 expensing, bonus depreciation, the tangible property regulations.

Source: www.unitedevv.com

Source: www.unitedevv.com

Section 179 and Bonus Depreciation at a Glance United Leasing & Finance, Tax rules for 2021 allow section 179 bonus deduction of the entire purchase or lease price for equipment used exclusively for the business up to $1,050,000 with an.

Source: veronikawflo.pages.dev

Source: veronikawflo.pages.dev

2024 Bonus Depreciation Percentage Table Nelie Xaviera, 179 deduction for tax years beginning in 2024 is $1.22 million.

Source: www.calt.iastate.edu

Source: www.calt.iastate.edu

Line 14 Depreciation and Section 179 Expense Center for, Explain how strategies like section 179 expensing, bonus depreciation, the tangible property.

:max_bytes(150000):strip_icc()/Term-Definitions_Section-179-resized-1a04b9f84c4d4141b11d1d9ca10fb981.jpg) Source: cabinet.matttroy.net

Source: cabinet.matttroy.net

Irs Depreciation Tables For Computers Matttroy, 179 expense deduction is limited to $25,000 for any suv or other vehicle rated at more than 6,000 pounds gross vehicle weight and not more than 14,000 pounds gross.

Source: www.youtube.com

Source: www.youtube.com

6000lb Bonus Depreciation Rule Section 179 Explained YouTube, When considering whether to utilize section 179 deductions instead of bonus depreciation in the year 2024, it’s crucial to understand the potential impact on both cash flow and tax liability.

Source: zeldaqbernadette.pages.dev

Source: zeldaqbernadette.pages.dev

Bonus Depreciation Limits 2024 Dita Donella, 179 deduction for tax years beginning in 2024 is $1.22 million.

Source: www.formsbank.com

Source: www.formsbank.com

Modifications Related To Bonus Depreciation & Section 179 Expensing, Explain how strategies like section 179 expensing, bonus depreciation, the tangible property.

Posted in 2024